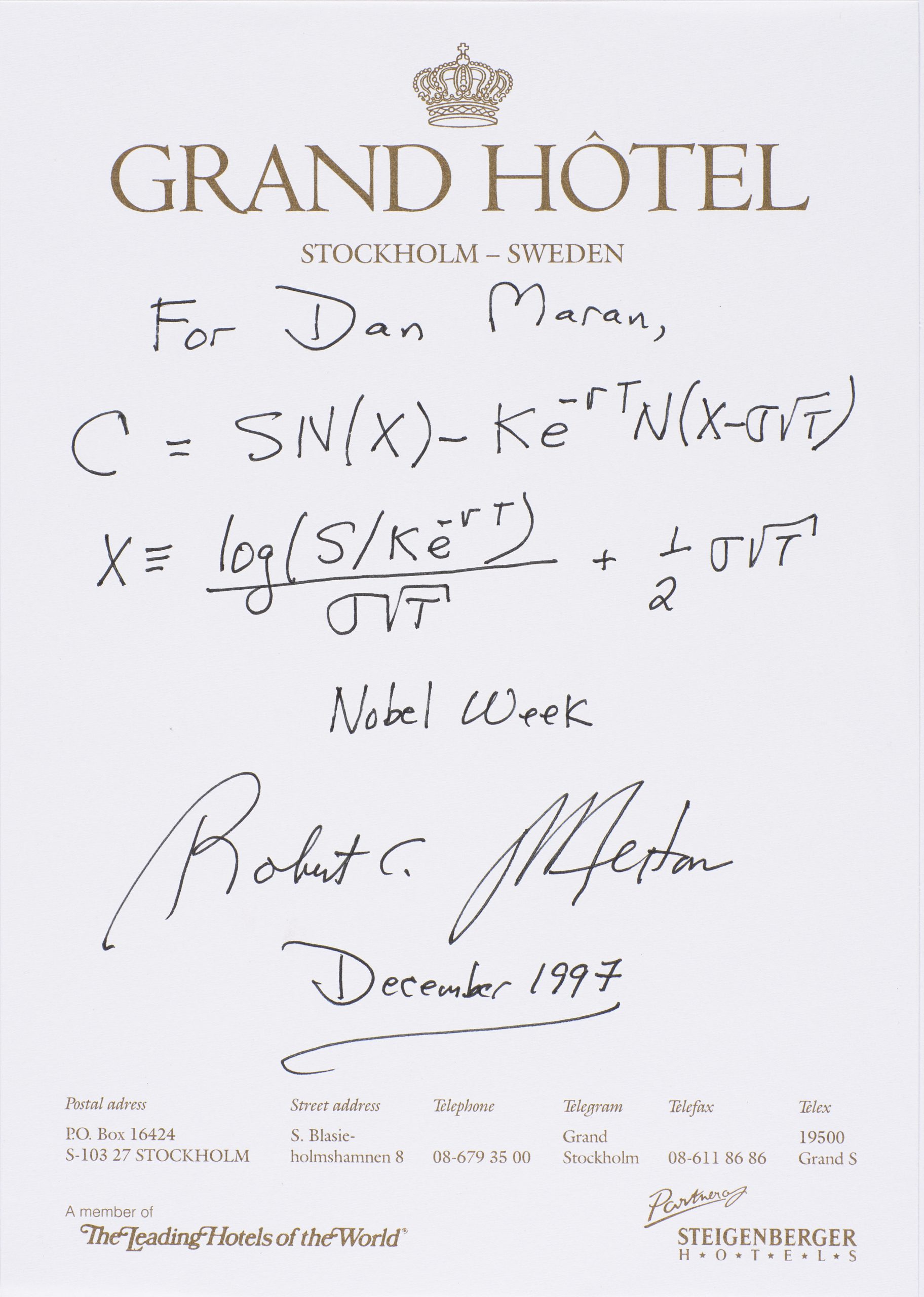

the most famous formula in derivatives trading

MERTON, ROBERT C.. Autograph manuscript signed, the Black-Scholes-Merton formula.

Stockholm, “Nobel Week", December 1997

One page. Stockholm Grand Hotel stationery. Fine.

In this outstanding financial manuscript, Merton writes the celebrated Black-Scholes (or Black-Scholes-Merton) formula for derivatives pricing, the basis for many of the great fortunes in finance.

Merton’s collaborator Myron Scholes characterized the formula as “an equation that prices options on common stock and provides a methodology to value options on securities generally. It can be used to measure risk and transfer risk.”

Merton and Scholes shared the 1997 Nobel Prize in Economics “for a new method to determine the value of derivatives” (Black was not eligible, having died in 1995). “Such rapid and widespread application of a theoretical result was new to economics,” the prize committee wrote. “Nowadays, thousands of traders and investors use the formula every day,” allowing businesses and individuals to hedge risks in an unprecedented way. Merton wrote this manuscript while he was in Stockholm for the Nobel Prize ceremony.

The insights of this model laid the foundation of modern trading in options and other derivatives. It thus has been the basis for the rise of numerous great fortunes in recent years. Black–Scholes “underpinned massive economic growth” so that the “international financial system was trading derivatives valued at one quadrillion dollars per year” by 2007, with the Black–Scholes equation being the “mathematical justification for the trading” (Ian Stewart, In Pursuit of the Unknown: 17 Equations That Changed the World).

We find no other manuscripts of this landmark formula in the auction records or in the market. This manuscript, written when Merton received the Nobel Prize, is worthy of any great collection in economics and finance.

$28,000